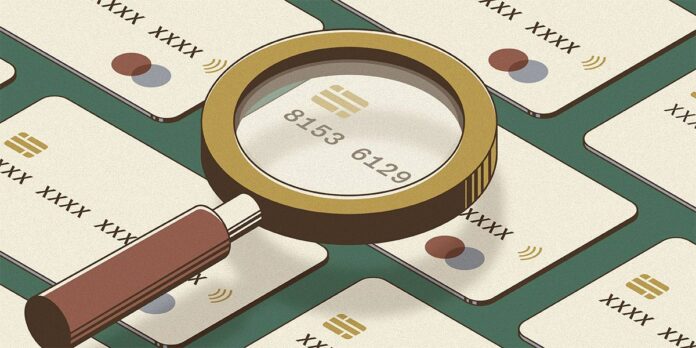

What Is the Meaning of a Bank Identification Number (BIN)?

The first four to six numbers on a payment card are referred to as the bank identification number (BIN). This string of numbers is used to identify the financial institution that issued the card. As a result, it associates transactions with the issuer of the card being used. BINs can be found on a variety of payment cards, including credit, charge, and debit cards.

The BIN system assists financial organisations in detecting counterfeit or stolen payment cards and can aid in the prevention of identity theft.

The Function of Bank Identification Numbers (BINs)

The American National Standards Institute (ANSI) and the International Organisation for Standardisation (ISO) developed the bank identification number to identify institutions that issue payment cards. The ANSI is a nonprofit organisation (NPO) that develops business standards in the United States, whereas the ISO is a worldwide nongovernmental organisation that develops standards for a variety of industries.

Every payment card has a BIN number. This is a collection of four to six numbers that are assigned at random to debit cards, credit cards, charge cards, gift cards, electronic benefit cards, and other payment cards.

The number is imprinted on the front of the card and printed right below it. The first digit identifies the principal industry. The following digits identify the issuing institution or bank. Visa credit cards, for example, begin with a four and fall under the banking and finance sector.

When a customer makes an online purchase, they enter their credit card information on the payment page. The online shop can determine which institution issued the customer’s card after inputting the first four to six digits of the card, including:

- The card’s manufacturer or Visa, MasterCard, American Express, and Diner’s Club are examples of major industry identifiers.

- The status of the card, such as corporate or platinum

- The kind of card

- The country of the issuing bank

When a consumer initiates a transaction, the issuer receives an authorization request and checks to see if the card and account are authorised and the purchase amount is available. The charge is either allowed or denied as a result of this process. The credit card processing system would be unable to execute the transaction without a BIN because it would be unable to determine the origin of the customer’s funds.

How can I use my Bank Identification Number (BIN) to make a purchase?

Using the BIN number to purchase items is simple and straightforward. To acquire items using bin numbers, follow the steps outlined below:

To begin, obtain the 6-digit number (BIN) from the online generator based on the country and bank.

- Select a VPN, and the BIN number should match.

- Let’s look at an example of the BINS approach in action for Scribd.

- Launch your web browser (ideally Mozilla Firefox).

- Credit cards can be generated using the generator site.

- Visit the Scribd website and select the 30-day free trial option.

- Use free premium mail to sign up.

- Enter the credit card information you generated.

- Here is your Scribd premium account, which is now active.

You may use BIN to sign up for other websites in a similar manner. I hope you now understand how to use bin numbers to buy items and process them quickly.

What exactly is BIN Number Attack Fraud?

Have you ever heard of BIN Attack? Let’s go over exactly what a bin number attack is. BIN numbers are used by fraudsters in scams known as BIN attack Fraud. Using the software, they receive a BIN and produce other numbers. They run minor transactions to test the numbers till they acquire a legitimate and working card number.

How do you spot BIN attacks?

After learning what a bin number assault is, it’s time to learn how to spot one. Some indicators indicate whether or not there is a BIN attack. The signs are as follows:

- Your account has several slow-valued transactions.

- Multiple refused transactions that you did not complete.

- Significant international deals.

- Unusual transaction volume.

Bank Identification Numbers – Frequently Asked Questions

- What exactly is a bank identity number (BIN)?

Ans. BIN numbers are the first 4-5 digits of a credit card that identify the company that issued the card. These numbers are set for industries, such as 4 and 5 for the banking sector.

- What does a bank identity number (BIN) mean?

Ans. A BIN number aids in the detection of fraud and protects both the merchant and the cardholder from robbery.

Conclusion-

Finally, our journey from digits to data has revealed the complex world of Bank Identification Numbers (BINs). These seemingly insignificant six digits serve an important function in the financial world, acting as a portal to a variety of information regarding credit and debit cards.

As previously discussed, BINs not only identify the issuing bank but also provide information on the type of card, its level, and even geographic information. This detailed tutorial seeks to debunk the myths surrounding BINs, providing light on their critical role in allowing secure and efficient financial transactions.