Within the Indian income tax framework, salaried individuals with income tax deducted at source (TDS) by their employers must file an income tax return. Also, navigating the intricacies of tax filings can often be daunting, especially for such individuals. This process necessitates a critical document: Form 16. This formal communication serves as a comprehensive guide to understanding Form 16, its constituent parts, and its paramount importance within the tax filing landscape.

You may also like: How to calculate ctc

This certificate, issued annually by employers, provides a detailed summary of an employee’s income and the taxes deducted at source (TDS). Understanding Form 16 is crucial for anyone looking to ensure accurate tax filings and compliance with tax regulations.

This blog guide delves into the various aspects of Form 16, including its components, importance, and how to access it, alongside other related forms like Form 16A and Form 16B.

What is Form 16 all about?

Form 16 is a certificate issued by employers to their employees, summarizing the income earned and taxes deducted at source (TDS) on that income during a financial year. It serves as proof of the tax deducted and paid to the government on behalf of the employee.

For instance, if you earned a salary of [INR 10,00,000] in the financial year 2022-23, and your employer deducted a TDS of [INR 1,00,000], this information will be summarized in your Form 16. This form is essential for salaried individuals, as it simplifies the process of filing Income Tax Returns (ITR) and helps verify tax calculations.

Read more : how to calculate HRA in salary

Why is Form 16 Required: Importance of Form 16

Form 16 is crucial for several reasons:

-

Proof of Income and TDS

Form 16 provides a detailed and accurate summary of the income earned and taxes deducted, ensuring transparency and accuracy in tax filings. This reliability of Form 16 reassures the reader that their tax calculations are correct, giving them a sense of security about their tax filings.

-

Simplifying ITR Filing

Consolidating all necessary details makes the process of filing ITR straightforward and hassle-free.

-

Verification of Tax Calculations

It helps verify that the taxes deducted and paid match the actual liability, preventing discrepancies.

-

Assisting in Obtaining Refunds

Form 16 assists in claiming refunds from the Income Tax Department in case of excess tax deductions.

-

Document for Loan Applications

Banks and financial institutions often require Form 16 to assess the income and tax liability of applicants.

You may also like:

When Will Form 16 Be Available For FY 2022-23?

Employers are required to issue Form 16 by June 15th of the following financial year. For the financial year 2022-23, Form 16 will be available by June 15, 2023. Employees should ensure they receive this form from their employers within this time frame to file their ITR timely and accurately.

You may also like: Salary certificate format

Components of Form 16

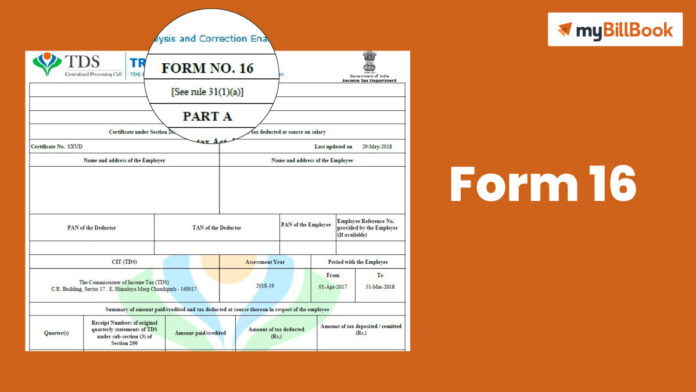

Form 16 is divided into two parts:

Part A:

This section has basic information. It includes the employer’s and employee’s name and address, PAN and TAN details, a summary of tax deducted and deposited quarterly, and the assessment year.

Part B:

This section provides a detailed breakdown of the salary paid, other incomes, deductions claimed under Chapter VI-A, relief under section 89, and the total tax payable or refundable.

Part A Details:

– Employer’s and Employee’s Name and Address

– PAN and TAN of Employer

– PAN of Employee

– Summary of Tax Deducted and Deposited Quarterly

Part B Details:

– Detailed Salary Breakup

– Allowances Exempt under Section 10

– Deductions under Chapter VI-A (e.g., 80C, 80D)

– Relief under Section 89

– Total Taxable Income

– Total Tax Payable or Refundable

What is Form 16A?

Form 16A is a TDS certificate issued for income other than salary. It includes details of TDS on income such as interest on securities, dividends, or any other income where TDS is applicable.

Details of Form 16A

Ensure you have the following information:

– Name and address of the deductor

– Name and address of the deductee

– PAN of Both Parties

– TAN of the Deductor

– Summary of Payment Made and TDS Deducted and Deposited Quarterly

What is Form 16B?

Form 16B is a TDS certificate for tax deducted at source on the sale of immovable property.It indicates the TDS deducted on the sale consideration and is issued by the buyer to the seller.

Details of Form 16B

– Name and Address of the Buyer and Seller

– PAN of Both Parties

– Details of the Property Sold

– Amount Paid and Tax Deducted

Essential Terms Mentioned in Form 16

– Assessment Year

The year following the financial year in which the income is assessed.

– PAN

Permanent Account Number.

– TAN

Tax Deduction and Collection Account Number.

– Gross Salary

Total earnings before deductions.

– Deductions

Amounts reduced from gross income under various sections (e.g., 80C, 80D).

Points to Remember When Receiving Form 16

– Verify Personal Details

Ensure all personal information such as name, PAN, and address is correct.

– Check Financial Figures

To verify the accuracy of all financial details, including salary, deductions, and tax calculations, you can cross-check them with your salary slips and other relevant documents. This will help you ensure that the details in your Form 16 are correct and match your actual income and tax liability.

– Employer’s TAN and TDS Amount

Confirm the employer’s TAN and the total TDS amount.

– Consistency Between Parts

Ensure consistency between Part A and Part B.

– Receipt of All Relevant Forms

Make sure you receive all relevant forms (16, 16A, 16B) as applicable.

Difference Between Form 16, Form 16A, and Form 16B

How to Download Form 16 Online?

Form 16 can be easily accessed and downloaded from the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website. While employers typically provide it to employees, it’s also available online through the employee’s account if the employee has registered. This convenient online access takes away the hassle of waiting for the physical form, providing a sense of relief to the reader.

Steps to Download Form 16

- Visit the TRACES Website: Go to the official TRACES website.

- Login: Use your credentials to log in to your account.

- Navigate to Form 16: Find the section for downloading Form 16.

- Select Financial Year: Choose the financial year for which you need the form.

- Download: Download and save the form.

Conclusion

Form 16 is not just a document, it’s a tool that empowers salaried individuals to manage their taxes effectively. It ensures compliance with tax regulations and simplifies the ITR filing process. By understanding its components and how to access it, individuals can confidently file their returns and manage their tax obligations. This knowledge allows them to ensure the accuracy of the details and timely receipt of Form 16, giving them a sense of control over their tax affairs.

Frequently Asked Questions About Form 16

How do you get a Form 16?

The employer provides form 16. If the employer has made it available on the TRACES website, it can also be downloaded.

What is Form 16 issued for?

Form 16 is issued as a certificate for salary income, detailing the income earned and TDS deducted.

How do I file my return if I do not have Form 16?

If you do not have Form 16, you can still file your return using your salary slips, Form 26AS, and bank statements to compute your total income and TDS.

What is the Form 16 issue date?

Form 16 is generally issued by June 15th of the following financial year.

Can I recover my Form 16 from a tax website if I still need to take a copy from my previous employer?

Yes, if your employer has uploaded it on the TRACES website, you can recover it from there.

If no Form 16 has been issued to me, does it mean I don’t have to pay tax or file a return?

No, you are still required to pay taxes and file a return based on your income. Form 16 is just a certificate of TDS; its absence does not exempt you from tax obligations.

Can you generate Form 16 without PAN?

No, PAN is essential for the generation of Form 16.

How do you download Form 16 for Previous Years?

If your employer has made it available there, you can download Form 16 for previous years from the TRACES website.

Who issues Form 16 for pensioners?

Form 16 for pensioners is issued by the bank or the organization disbursing the pension.